The GST on solar products has been increased from 5% to 12%. From 1st October onwards all solar products or solar panel systems will attract a GST of 12%.

Therefore, in this article, I’ve explained the billing pattern of the off-grid solar panel system and how the tax structure should be on the invoice.

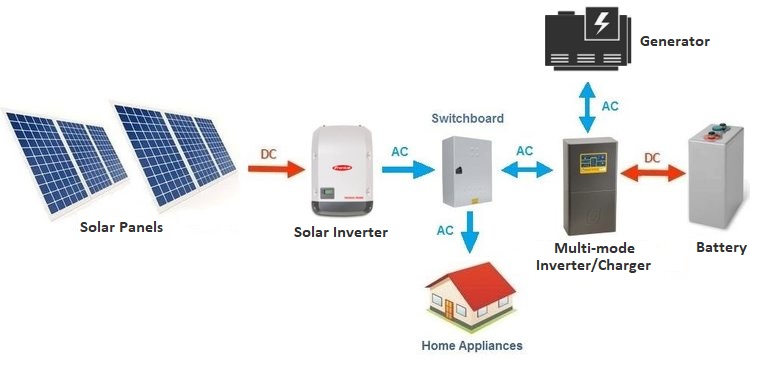

Off-Grid Solar Panel System Components

An off-grid solar panel system consists of:

- Solar PV Modules

- AC/DC Cable

- ACDB & DCDB Boxes

- Solar Structure

- Solar Inverter

- Cable Trays

- Walkways

- Safety Lines

- Battery

The GST on the battery is 28%. So, to avoid 28% GST the billings are done as the off-grid solar systems. In an off-grid solar system, the battery acts as an important part (storage). Hence, the total system is sold with 12% GST.

You can check this in the market also. Just try to buy a battery, the GST charged will be 28%. And if you buy an Off-Grid Solar system in which there is a solar module, inverter & battery, then the GST charged will be 12%.

Billing Pattern for Off-Grid Solar Panel System

Intra-State GST Invoice on Solar Panel System

Below is an example of an intra-state GST invoice,

| Rate Rs 90000 Per kW system capacity 4 kW with 12 V 150 Ah – 10 battery (numbers assumed) | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Off-Grid Solar System | 8541 | 1 | 360000 | 360000 |

| Total | 360000 | ||||

| CGST 6% | 21600 /- | ||||

| SGST 6% | 21600 /- | ||||

| Total | 43200 |

Inter-State GST Invoice on Solar Panel System

Below is an example of an inter-state GST invoice,

| Rate Rs 90000 Per kW system capacity 4 kW with 12 V 150 Ah – 10 battery (numbers assumed) | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Off-Grid Solar System | 8541 | 1 | 360000 | 360000 |

| Total | 360000 | ||||

| IGST 12% | 43200 | ||||

| Grand Total | 403200 |

NOTE: Individual billing is also an option but definitely making more GST charges as for Off-Grid system blanket charges are 12%.

However, all BOS is at 18% and Battery at 28% resulting in a very very high cost to end consumers under B2C trade. Hence this option is not advisable.

Information Compiled By

- Yogesh Mundhra

For more information on taxation, you can contact & coordinate with Mr. Yogesh Mundhra on his WhatsApp No: 9168616101. - Ajit Bahadur

Hope this information is useful for you, please share it with others.

Support the solar industry.