The GST on solar products has been increased from 5% to 12%. From 1st October onwards all solar products or solar panel systems will attract a GST of 12%.

Therefore, in this article, I’ve explained the billing pattern of the on-grid solar panel system and how the tax structure should be on the invoice.

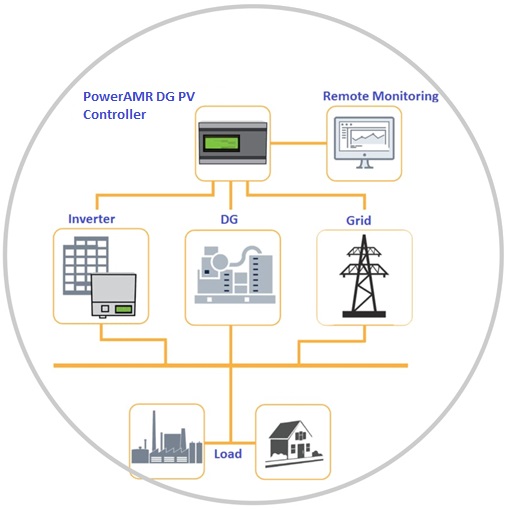

Billing Pattern for Hybrid Solar Panel System

Hybrid Systems will have the same taxation as On-Grid systems. However, if we opt for individual item billing patterns, need to bill the battery at 18% and the description to be “Batteries for Solar system”.

Recommendation: Most of the houses are already having normal inverters for their critical load, so it’s better to go with a simple On-Grid solar system.

The system will be simple, less costly, less complicated and less maintenance, and ultimately you will save your electricity bill, resulting in faster payback.

There are broadly 2 types and each has 2 subtypes.

- Total System Billing

- Intra-State Billing

- Inter-State Billing

- Each Product Billing

- Intra State Billing

- Inter-State Billing

Intra-State GST Invoice on Solar Panel System

Below is an example of an intra-state GST invoice as per the 70:30 ratio pattern,

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar Modules & Solar Inverter | 8541 | 1 | 140000 | 140000 |

| 2. | BOS & Services ( assumed amount) | 9954 | 1 | 60000 | 60000 |

| Total | 200000 | ||||

| (70% @12% : 30% @ 18 %) | |||||

| CGST 6% | 140000 /- | 8400 /- | |||

| SGST 6% | 8400 /- | ||||

| CGST 9% | 60000 /- | 5400 /- | |||

| SGST 9% | 5400 /- | ||||

| Grand Total | 227600 |

BOS & Service includes 18% tax: Electrical fittings, CCTV, plumbing, civil work, transportation, Tin shed, structure, Land leveling, LA, earthing, ACDB, DCDB, etc.

Inter-State GST Invoice on Solar Panel System

Below is an example of an inter-state GST invoice as per the 70:30 ratio pattern,

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar modules & solar inverter | 8541 | 1 | 140000 | 140000 |

| 2. | BOS & Services (assumed amount) | 9954 | 1 | 60000 | 60000 |

| Total | 200000 | ||||

| (70% @12% : 30% @ 18%) | |||||

| IGST 12% | 140000 | 16800 | |||

| IGST 18% | 60000 | 10800 | |||

| Grand Total | 227600 |

BOS & Service includes 18% tax: Electrical fittings, CCTV, plumbing, civil work, transportation, Tin shed, structure, Land leveling, LA, earthing, ACDB, DCDB, etc.

Separate Intra-State GST Invoice on Solar Panel System

Below is an example of a separate Intra-state GST invoice on a solar panel system,

Invoice 1 – For 12% GST:

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar modules ( 500 Wp * 8 nos) | 8541 | 8 | 15000 | 120000 |

| 2. | Solar inverter ( Price assumed ) | 8504 | 1 | 50000 | 50000 |

| Total | 170000 | ||||

| CGST 6% | 10200 | ||||

| SGST 6% | 10200 | ||||

| Grand Total | 190400 |

Invoice 2 – For 18% GST:

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | BOS – Erection, Installation & Commissioning Services | 9954 | 1 | 30000 | 30000 |

| Total | 30000 | ||||

| CGST 9% | 2700 | ||||

| SGST 9% | 2700 | ||||

| Grand Total | 35400 |

Information Compiled By

- Yogesh Mundhra

For more information on taxation, you can contact & coordinate with Mr. Yogesh Mundhra on his WhatsApp No: 9168616101. - Ajit Bahadur

Hope this information is useful for you, please share it with others.

Support the solar industry.

hi want to know more about solar panel bificial hybrid settings for home solar roof top with cost outline and equipment as well as benefits vs offgrid or ongrid , single and three phase line.

You can book our paid consultancy: https://solarismypassion.com/solar-consultancy/