The GST on solar products has been increased from 5% to 12%. From 1st October onwards all solar products or solar panel systems will attract a GST of 12%.

Therefore, in this article, I’ve explained the billing pattern of the on-grid solar panel system and how the tax structure should be on the invoice.

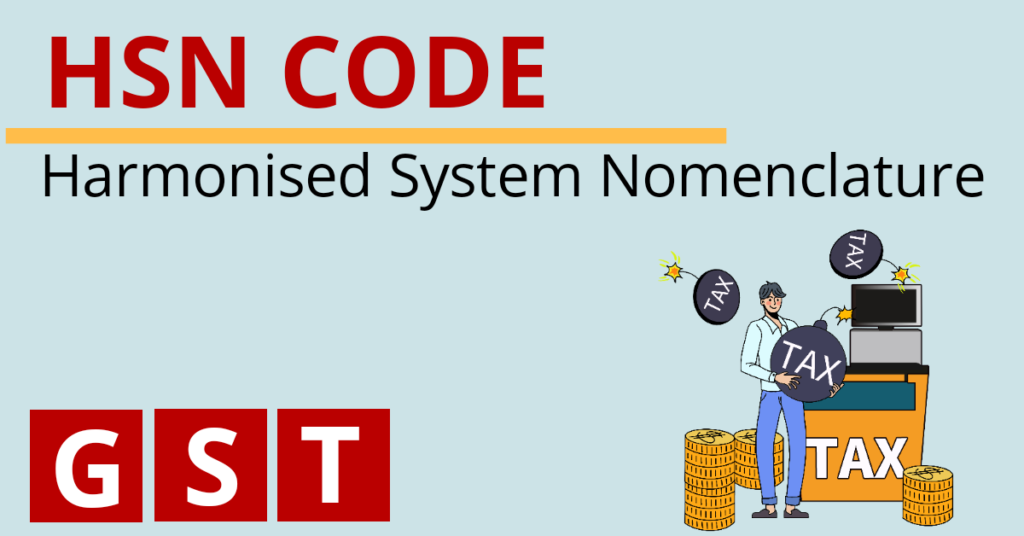

HSN Code of Solar Products

| No. | Item | HSN Code | Applicable Tax |

| 1. | Solar modules | 8541 | 12% |

| 2. | Solar Inverter with PV module | 8504 | 12% |

| 3. | Solar Water Heater | 8419 | 5% |

| 4. | Battery | 8705 | 28% |

| 5. | Al Mounting Structure | 7610 | 18% |

| 6. | GI Mounting Structure | 7308 | 18% |

| 7. | Plumbing/Piping | 7304 | 18% |

| 8. | Solar Charge Controller with PV module | 5804 | 12% |

| 9. | Data Loggers, Wi-Fi | 8517 | 18% |

| 10. | Solar Lantern, Solar street light, Solar Home lighting kit with PV module | 9405 | 12% |

| 11. | Cables | 8544 | 18% |

| 12. | Earthing/Safety/LA | 8536 | 18% |

| 13. | Cable tray, accessories | 7308 | 18% |

| 14. | Erection, Installation & Commissioning Services | 9954 | 18% |

- Please consult the tax authorities for items not mentioned in the list

- Note: For a specified Turnover (Currently above 5 Crores), 8 digit HSN Code is Must.

Apart from that anything which is sold in the name of SOLAR i.e Solar AC, Solar Fan, Solar Cooler, Solar Induction, should have a component of solar – Solar PV.

It is just like – anything painted in green doesn’t mean green energy or renewable energy.

So anything which has a solar PV as a component is considered a solar product or system.

You can have a check from your end. Just try to buy a solar fan, solar AC or a solar cooler, it will come with a solar component (Solar PV). If it’s not having then there is some problem.

As a dealer if you are doing this, then you are requested to get it checked, as it may create some problems in the future.

Solar Panel System GST Invoice – Important Points

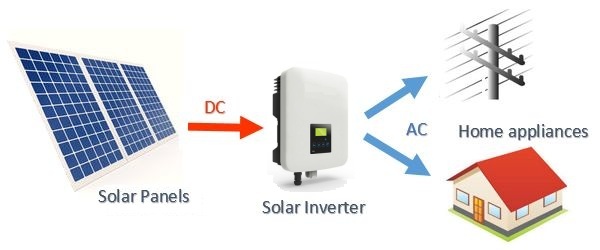

Let’s understand the solar panel system first,

A solar panel system consists of:

- Solar PV Modules

- AC/DC Cable

- ACDB & DCDB Boxes

- Solar Structure

- Solar Inverter

- Cable Trays

- Walkways

- Safety Lines

- Battery (for off-grid/hybrid systems)

Or the configuration may change as per the system type.

So whatever is necessary/important for a solar panel system, is considered as a part of a solar panel system.

For example, a CCTV is not a part of the solar panel system – though it’s the requirement of the site or client, the tax structure for CCTV will be as per set guidelines. Similarly, civil work at the site is not included in a solar panel system. It can’t be included in the system to avoid tax.

Assessment authorities also know what is necessary and what is important in a solar panel system. So don’t include extra items to save tax or avoid tax. If you practice this, then there can be a problem in the future.

This has happened before and many manufacturers or EPCs have already faced huge penalties in the past.

Billing Pattern for On-Grid Solar Panel System

There are broadly 2 types and each having 2 subtypes.

- Total System Billing

- Intra-State Billing

- Inter-State Billing

- Each Product Billing

- Intra State Billing

- Inter-State Billing

There are two options you can follow:

- 70:30 Ratio Pattern – In this pattern, 70% will attract 12% GST and the remaining 30% will attract 18% GST. This pattern is followed in smaller systems (1-10 kW GCRT system), as the time required and project size is small, where generally the bill is made only once.

- Separate Billing – Separate billing for 12% components and 18% components. Here two or more bills will be generated for the same project. This pattern is followed in big systems (10 kW-MW level projects), as the time required and project size is big.

Note: Straight 13.80% on the complete system is a wrong method as while filing GST return, 13.8% tax slab is not available. Don’t fall into the trap of “Jhat Pat billing“.

This is followed where you can just calculate the total tax structure (for calculation purposes, not for actual billing)

Intra-State GST Invoice on Solar Panel System

Below is an example of an intra-state GST invoice as per the 70:30 ratio pattern,

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar Modules & Solar Inverter | 8541 | 1 | 140000 | 140000 |

| 2. | BOS & Services ( assumed amount) | 9954 | 1 | 60000 | 60000 |

| Total | 200000 | ||||

| (70% @12% : 30% @ 18 %) | |||||

| CGST 6% | 140000 /- | 8400 /- | |||

| SGST 6% | 8400 /- | ||||

| CGST 9% | 60000 /- | 5400 /- | |||

| SGST 9% | 5400 /- | ||||

| Grand Total | 227600 |

BOS & Service includes 18% tax: Electrical fittings, CCTV, plumbing, civil work, transportation, Tin shed, structure, Land leveling, LA, earthing, ACDB, DCDB, etc.

Inter-State GST Invoice on Solar Panel System

Below is an example of an inter-state GST invoice as per the 70:30 ratio pattern,

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar modules & solar inverter | 8541 | 1 | 140000 | 140000 |

| 2. | BOS & Services (assumed amount) | 9954 | 1 | 60000 | 60000 |

| Total | 200000 | ||||

| (70% @12% : 30% @ 18%) | |||||

| IGST 12% | 140000 | 16800 | |||

| IGST 18% | 60000 | 10800 | |||

| Grand Total | 227600 |

BOS & Service includes 18% tax: Electrical fittings, CCTV, plumbing, civil work, transportation, Tin shed, structure, Land leveling, LA, earthing, ACDB, DCDB, etc.

Separate Intra-State GST Invoice on Solar Panel System

Below is an example of a separate Intra-state GST invoice on a solar panel system,

Invoice 1 – For 12% GST:

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | Solar modules ( 500 Wp * 8 nos) | 8541 | 8 | 15000 | 120000 |

| 2. | Solar inverter ( Price assumed ) | 8504 | 1 | 50000 | 50000 |

| Total | 170000 | ||||

| CGST 6% | 10200 | ||||

| SGST 6% | 10200 | ||||

| Grand Total | 190400 |

Invoice 2 – For 18% GST:

| Rate Rs 50000 Per kW – System capacity 4 kW | |||||

| Sl.no | Particulars / Item | HSN | Quantity | Rate | Amount |

| 1. | BOS – Erection, Installation & Commissioning Services | 9954 | 1 | 30000 | 30000 |

| Total | 30000 | ||||

| CGST 9% | 2700 | ||||

| SGST 9% | 2700 |

Information Compiled By

- Yogesh Mundhra

For more information on taxation, you can contact & coordinate with Mr. Yogesh Mundhra on his WhatsApp No: 9168616101. - Ajit Bahadur

Hope this information is useful for you, please share it with others.

Support the solar industry.